Students follow the trend and invest their hard earned cash

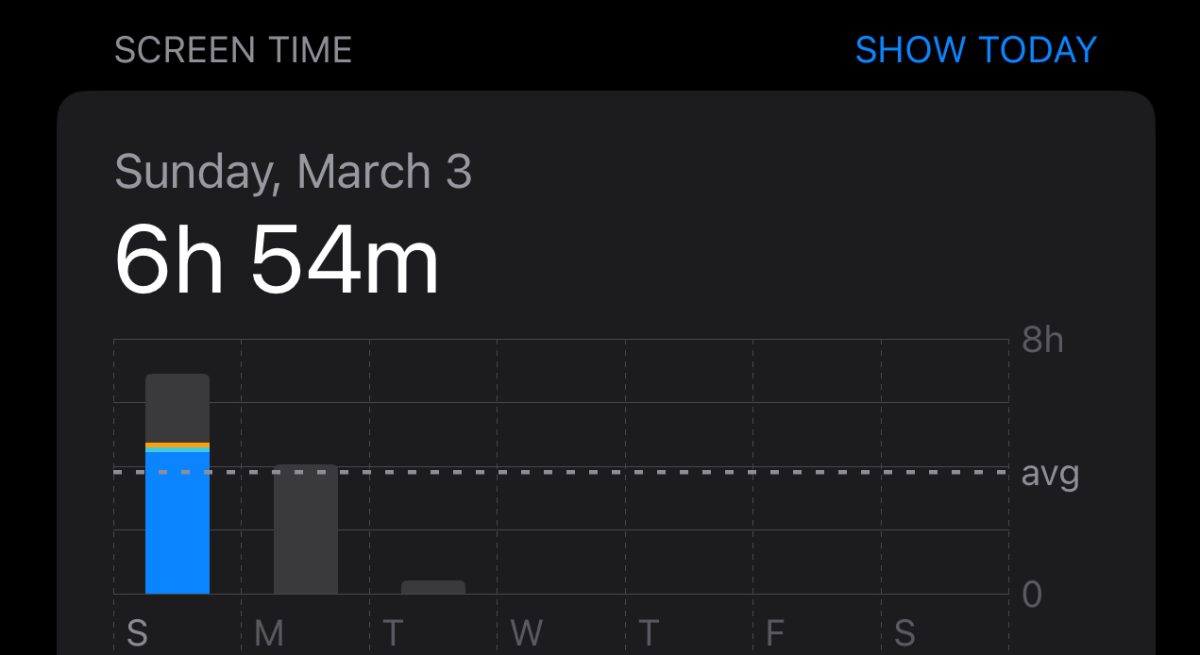

The stock market is more available to the average person now than ever before and has made an incredible run since the start of the pandemic, leading to a huge increase in the amount of brokerage accounts with certain companies like robinhood.

Some students at BSM have followed the trend and started investing themselves. Senior Ian Thorstenson got a head start and started investing when he was 16 with a TD Ameritrade custodial account set up with his parents. “I wanted to make more money with the cash I got from my job and wanted to grow my savings,” Thorstenson said.

Investing as a high school student can lead to more growth down the road because of compound growth but if not taken seriously it can also lead to big losses. “It is a nuclear reactor; it can be really good or bad. You have to minimize risk and understand what you do and don’t know,” business teacher Mr. John Sabol said.

You have to minimize risk and understand what you do and don’t know.

— John Sabol

Sabol recommends using a commission free brokerage account and to diversify risk by using mutual funds. He also recommends taking advantage of long term growth by not selling often and consistently buying. Day trading is something he says to avoid unless you have a clear advantage and really know what you are doing.

In contrast to Sabol, Thorstenson thinks that taking some risk makes sense because it can lead to much bigger gains. “Don’t be afraid to take risks,” Thorstenson said.

For both students and adults, a strong knowledge base is necessary for serious investing. “If you are interested in a career involving the stock market you should pursue a degree in finance, math, economics, or computer science. Also go out and get internships and network with people in the field,” Sabol said.