How Andrew Torrance lost $200 through stocks

Andrew Torrance reflects on a younger and more foolish time, in which he lost $200 with the help of Tesla and their stock.

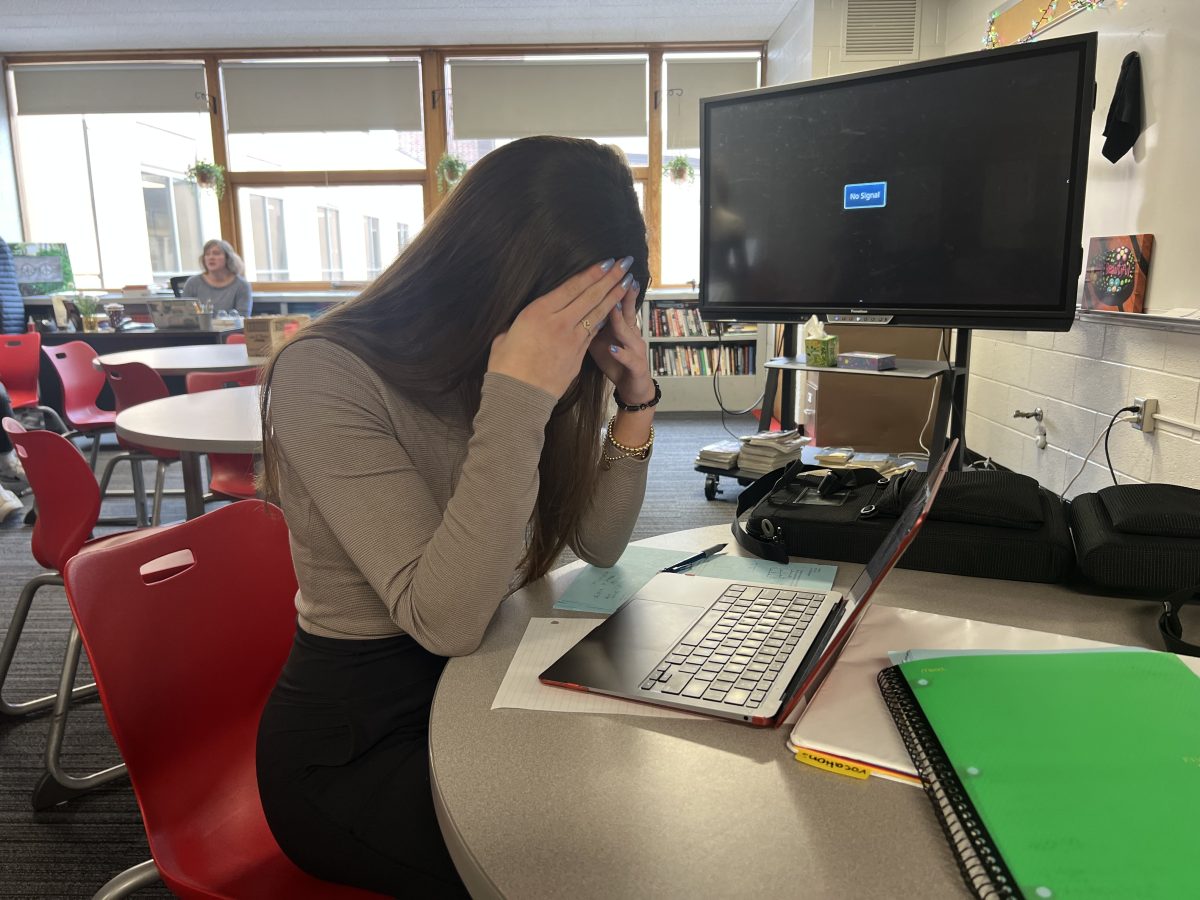

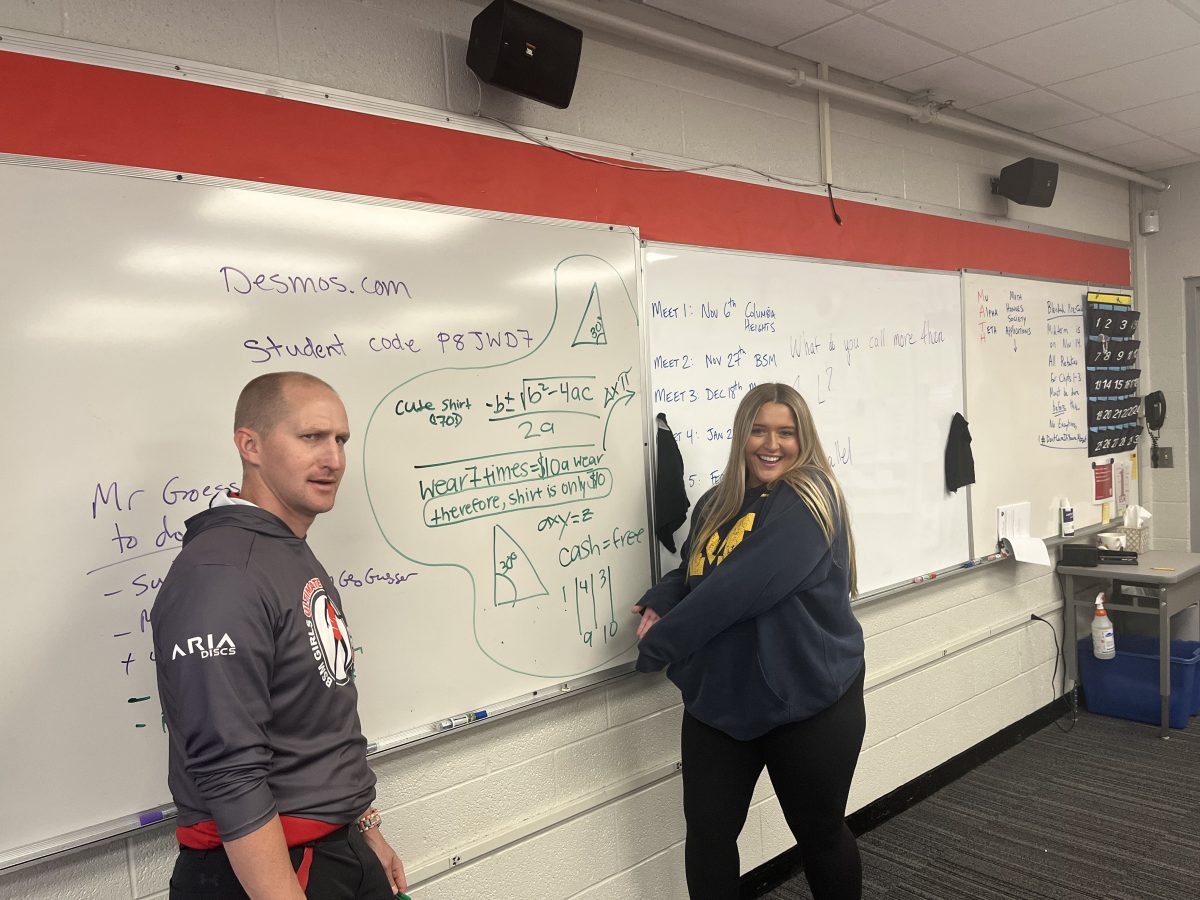

Drew Torrance sits in confusion at the New York Stock Exchange. Silly Andrew should’ve never bought that Tesla stock—what a goof.

‘Twas the summer of 2015, I was overly ambitious, a tad cocky, and I had just figured out how to buy stocks. Notice how I didn’t say, “I had acquired the knowledge necessary to successfully manage a diversified stock portfolio.” All I knew was how to buy a stock. Next, I sat down, thought about it for a minute and decided, “What the heck, why not buy Tesla?” Then, I did. I bought two shares for $256 each.

As the year went along, I was so excited to see how much money I was making on my investment. I thought it was worthwhile, but by the end of the first week in October, I had only lost $80. Looking at the long-term growth opportunity for Tesla, I stood firm in my position. I told myself that short-term results weren’t what I was concerned about. I was only concerned about the long-term growth of my position, so I decide not to look at it until January.

Once January rolled around, I took a look at the stock, and I was more surprised than a resident of Troy shortly after they received the kind gift of a large wooden horse. The stock wasn’t so much on a downward trend as it was on a steep cliff upon which dreams go to die. I had lost over $100 dollars by this point, but my gut was telling me that it was just a rough couple of months, and soon, I would be rolling in as much cash as Elon Musk. Turns out, this assumption was dumber than a room full of creationists.

Now I know the beginning of 2016 hit us all hard, but for me, it was truly a time of despair. On February 10, Tesla’s stock bottomed out, and I was $226 in the hole. At this point, I really wasn’t as pessimistic as I was convinced that it really couldn’t get any worse for Tesla. I thought that maybe Tesla would shoot back up, and I could break even, sell the stock, and learn how to diversify my portfolio.

The first part of this assumption was actually correct. In April, Tesla went up to about $260, and the average person with common sense would believe that this would be a good time to sell the stock and stop pretending to be Warren Buffett. Unfortunately for me, I am not the average person. Believing that Tesla is somehow a miracle stock, I held my position and watched as it lost 25% of its value over the next few months.

Finally, on December 2, 2016, I decided enough was enough. My hopes and dreams of being a successful investor had faded, and I didn’t want to lose any more money. Anticipating the continuing decline of the stock, I sold my shares for a loss of just under $200. This is literally the worst decision I could have made. Literally, the day after I sold my shares, Tesla began to see the largest period of sustainable growth it had seen in years, and if I had held the stock for just one more month, I would have been able to break even.

The moral of this story is that if you’re a witless investor like me, you should never buy stocks. Just don’t do it. Even if you think you’ve found some great opportunity to make money, just don’t buy stocks. I’ve even installed a monthly reminder on my phone to remind me to never buy stocks again. Just stick to mutual funds; they’re diversified, they’re safe, and you won’t even have the opportunity to make the kinds of foolish mistakes that I made.